Leveraging Gold As An Asset – Gold Holdings for Greater Returns

How do you build a portfolio with crashing depository rates?

A balanced portfolio is a salient strategy to minimize the risk and potentially increase gains. It is advisable to hold different types of assets classes that can give different types of returns, and as the proverb goes, do now no longer position all your eggs in single basket. Compared to various instruments and assets, the equity market has performed better than 2020 but has not been impressive, like making an investment in valuable metal gold.

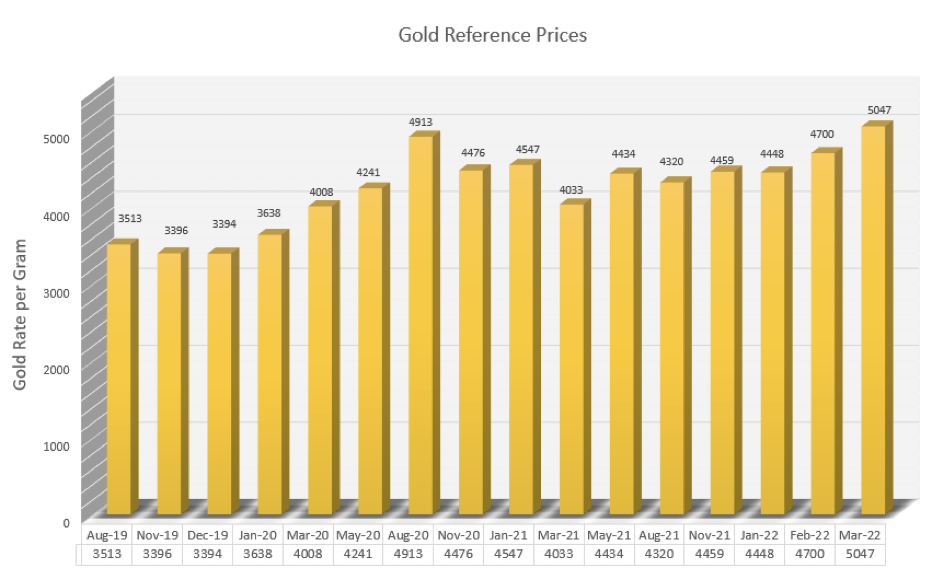

Considering the gold asset, it final peaked in August 2020, and for the first time, broke to INR 4913 per gram from simply INR 3513 per gram, concurrently in 2019. The prices of different investments such as stocks and real estate losing sharply in 2021 noticed many mutual funds directing investors to invest in gold funds as a diversifying asset. Investment in gold has reckoned to have touched around Rs 18,000 crores as of November.

With gold having risen above INR 5047 per gram on increased demand and as safe-haven assets as investors investigate the geopolitical and economic outcome, the rate of gold is probable to shoot up further. Although the value of gold moves higher, it is paramount to recognise that historically, it has proven to be a good hedge against weakened currency and inflation. Gold asset makes it an extremely safe investment with a good return, more so when we face living in unsure times.

Today with various asset classes available, there is a degree of scepticism in the young generations concerning the benefits of investment in all marketplace conditions. However, the better advantage with the youths is their age, time horizon and attention of lengthy-time period desires to select out the proper asset like making an investment in gold.

Gold was the investor’s desire for storing the value for a long time, thinking about investment as important as our ancestors may have embedded them into our culture. Therefore, sustaining investment in gold has been represented in Indian festivals such as Makar Sankranti, Dussehra, Navratri, Diwali, Akshaya Tritiya and Dhanteras. Akshaya Tritiya and Dhanteras are taken into consideration as highly auspicious to owning gold or new investments, a sentiment which Indians stay through to shield themselves throughout unsure times.

Gold is known as the best precious metal of value in the world. Gold has adorned numerous roles, from banking to the production of digital elements to jewellery. Yet this appealing material remains an unparalleled asset even to a commoner, with no huge investment requirement, unlike the stock and bond markets where you first get your finance in order, know your time horizon and pick the best. Gold has been performing well with positive returns over the long run, often outperforming major asset classes.

So, let me throw some light on the different ways of how one could invest in gold at C. Krishniah Chetty Group of Jewellers.

Today, there are different ways an investor can gain exposure to the gold asset via:

1. Purchase of physical gold.

2. Paper Gold and Paper Silver.

1) The most common way to invest is in its pure form 24 Kt, bullion usually available in the form of gold coins or bars and regularly deposited in safe storage. C. Krishniah Chetty Group of Jewellers have gold bullions available in 995 fineness in different denominations as small as one gram and above for investment.

The other alternative to investing in gold is in the form of gold jewellery. Although, not the same as an investment in pure gold. These 22Kt gold is crafted like a jewel and included the cost of manufacturing, wastage and other charges in specific cases, which are not related to the value of gold. This type of investment can be cherished rather than lying in a bank locker in solid form. Another prime fact is more the passing down the generation, the higher the value as an antique outside of its gold content.

At C. Krishniah Chetty Group of Jewellers, all our loyal customers have been investing in gold jewellery since generations to revel in the delight of fine craftsmanship, designs, gemstones and purity of metals. These finely crafted jewellery have become their own circle of relatives’ heirlooms adding emotional value beyond its intrinsic value at every step.

2) Paper Gold & Paper Silver: Another investment alternative of accumulating gold of 22KT and Sterling Silver of 92.50% without buying the physical assets. A plan with a variety of advantages as compared to other instruments such as Sovereign Gold Bond by Government of India or ETF/MFS of National Stock Exchange & Bombay Stock Exchange.

The best plan for new investors who wish to include gold into your portfolio with small capital. Begin investing as low as 5 grams for gold and 500 grams for Silver with the convenience of booking available online at www.ckcjewellers.com or offline showrooms. To be transformed later into proudly owning gold or diamond jewellery at a lower booking or billing rate within 11 months. If you opt to liquidate may be finished straight away with the prevailing days direct gold/silver purchase policy rate at C. Krishniah Chetty Group of Jewellers.

3) Gold Savings Plan: Investing in another signature program – GSTD or GAAP. The salient features are investing based on your financial situation, cutting-edge market conditions, or your investment horizon for owning a wardrobe of jewellery. Choose the lower: either the averaged rate or the current prevailing rate to benefit from the return on investment. For more details and enrolment, visit www.ckcjewellers.com/gaap-gstd.

The final goal of this article is to share our thoughts to have a balanced, well-diversified portfolio, wherein gold investments play a clear and specific role. From the expertise at C. Krishniah Chetty Group of Jewellers, we consider that one needs to invest around 5-10 per cent of their income in gold regularly to build a corpus in the long run. Although the return on investment in gold is based entirely on price appreciation, unlike the bonds or shares, they have been doing well for the last few years. However, gold fluctuated significantly during the few years and has staged a comeback with significant gains.